Save the date: IBA conference 2020 in Ukraine

It has been fixed: our next meeting will take place from 2nd to 5th June 2020. Save the date for the IBA conference 2020 in Ukraine.

The organizers of the IBA conference 2020 in Ukraine

Together with the IBA General Manager Stefanie Sharma, a team of four people from the Ukrainian Berry Association has started tough work. We want to offer you interesting presentations as usual, as well as farm visits and industrial discovery in a blackcurrant growing country which most of you don’t know yet. But first of all, let us introduce those who will be in the front line for the organization.

Irina Kukhtina

She is the creator of the new professional Ukrainian Berries Association, which was officially registered on May 22, 2017 as a professional association for the berry industry.

Irina takes an active part in the promotion of Ukrainian berries in international markets (international trade fairs, B2B meetings and trade missions, advertising campaigns in Ukraine, etc.). Within the UBA, she now manages a team of 8 people. “Ukraine’s berries industry is booming, demonstrating immense growth and providing one of the most attractive returns on investment in Ukrainian agriculture”, Irina says.

Elena Kaijen

Since 2018, Elena Kaijen has been working as the Executive Director of the Ukrainian Berries Association (UBA). Members of the Association are companies operating in the berry sector (soft and stone fruits): producers, processors, nurseries, research institutions. She took an active part in the development of a roadmap for the Berry market development in Ukraine.

Elena Kaijen helps companies to enter new sales markets by preparing certification and export requirements training, participating in international exhibitions and organizing B2B meetings during exhibitions.

Tetiana Smirnova

In May 2019, Tetiana joined the team of Ukrainian Berries Association. At the moment, her main tasks are information support of the UBA and members of Association and the management of UBA`s events.

She sincerely believes that the berry sector of Ukraine has great potential and that this country has chance to take its rightful place in the ranking of leading players in the world market.

Liubov Pavlenko

Liubov is the project manager of the Ukrainian Berries Association, a young specialist who is interested in further development in the field of berry business, with a focus on the development of the berry industry in Ukraine. She has been working for the Association since September 2018.

She is a project manager of “Eastern Partnership: Ready to Trade – an EU4Business initiative”, which is funded by the EU and implemented by the ITC (International Trade Center) and Ukrainian Berries Association.

More about the organizers on the website of the conference.

Place and dates

Where?

As already announced in one of our previous newsletters, the IBA conference 2020 in Ukraine will take place in Lviv. It is the seventh largest city of the country. Lviv is situated in the Western part of Ukraine, some 70 kilometers from the Polish border. Far, far away from the Donbass area, if some of you are afraid. But close to the blackcurrant growing area of the country – and that is what matters! We will be able to offer easy access by plane, as Lviv has its own airport, or by car for those who come from Poland.

The venue?

However, we haven’t fixed the venue yet. The organizers have several proposals, and will decide on the best solution before Christmas. It depends, of course, on the capacity of the hotel, the services offered, and the conference facilities that we need. We will keep you updated!

When?

As for the dates, we have decided to start in the evening of 2nd June 2020. An IBA Board meeting and a meeting of the agronomy working group will take place before the official start of the conference. For those concerned, you will receive invitations later. Presentations and visits will then take place from Wednesday 3rd until Friday 5th late morning. Everybody will then be able to leave around noon on Friday and reach back home before the week-end. Of course, you may also stay for another day or two to discover the region!

Expected programme

Visits

Like usual, we are trying to make the best of your time during the IBA conference 2020 in Ukraine. No doubt we will visit at least one exemplar blackcurrant farm and plantations, as well as a company.

Presentations – Focus on Eastern Europe and Central Asia

As for presentations, they will focus on what is unknown to most of the participants: blackcurrant growing and processing in Ukraine and other countries further East. The Ukrainian production kept growing over the past years, and processing further shifts from Poland to the East. But also other markets. Therefore, we found it most interesting to try and have presenters from this part of the world. They will share their knowledge of an area widely new and unexplored by the huge majority of the participants.

Any volunteers?

If any of our readers wants to bring in a presentation, has suggestions or questions, please feel free to contact us. We will do our best to include your wishes and knowledge!

Registrations for IBA conference 2020 in Ukraine

Registrations are not open yet. The website dedicated to the IBA conference 2020 in Ukraine is under construction. You can access it, as usual, here. Links to reservations for the venue, registration, sponsorship packages, programme and participation in the 3rd blackcurrant product competition will work shortly.

The Open Farm Day started in the morning of Saturday, 17th August 2019. Owner and manager Andris Krogzems welcomed his visitors. The Krogzeme farm is 99 ha land, out of which 56 ha are planted with blackcurrants, 5 ha with sea buckthorn and 6 ha with seedlings for blackcurrants. As an additional business, Andris is selling machinery for berry growing in the Baltics for several brands. The farm hires permanently 7 employees, has a turnover of up to 500.000 EUR per year and is a fully organic family farm.In the morning, Andris could welcome around 10 blackcurrant farmers, mainly from Lithuania, Estonia and Latvia. The day was divided into a theoretical part with presentations and discussions in the morning, and a practical field part in the afternoon, after a lunch break.

The Open Farm Day started in the morning of Saturday, 17th August 2019. Owner and manager Andris Krogzems welcomed his visitors. The Krogzeme farm is 99 ha land, out of which 56 ha are planted with blackcurrants, 5 ha with sea buckthorn and 6 ha with seedlings for blackcurrants. As an additional business, Andris is selling machinery for berry growing in the Baltics for several brands. The farm hires permanently 7 employees, has a turnover of up to 500.000 EUR per year and is a fully organic family farm.In the morning, Andris could welcome around 10 blackcurrant farmers, mainly from Lithuania, Estonia and Latvia. The day was divided into a theoretical part with presentations and discussions in the morning, and a practical field part in the afternoon, after a lunch break.

Further items of the morning theoretical part were the economic aspects of organic production. This does not look so bad in the country. Prices are 50-70% higher than conventional blackcurrants. And in general, Andris is able to sell his whole yield with a margin, as he told us. This is not only a question of the scale of his production. For the guests of the

Further items of the morning theoretical part were the economic aspects of organic production. This does not look so bad in the country. Prices are 50-70% higher than conventional blackcurrants. And in general, Andris is able to sell his whole yield with a margin, as he told us. This is not only a question of the scale of his production. For the guests of the

As a seller of machinery, Andris keeps himself very well informed. Mainly, he looks for all available technology to do an effective weeding of the organic bushes. He therefore showed the machinery parts according to his best experience in the fields. As an example, one tractor was weeding a row. This demonstration allowed the guests to immediately evaluate the effects of this operation.At the end, he showed us machinery for planting seedlings, for fertilizing with manure and of course for mechanical harvesting.

As a seller of machinery, Andris keeps himself very well informed. Mainly, he looks for all available technology to do an effective weeding of the organic bushes. He therefore showed the machinery parts according to his best experience in the fields. As an example, one tractor was weeding a row. This demonstration allowed the guests to immediately evaluate the effects of this operation.At the end, he showed us machinery for planting seedlings, for fertilizing with manure and of course for mechanical harvesting. Highly modern equipment, cleanliness, tidiness – and the warmest welcome at

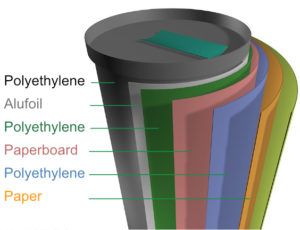

Highly modern equipment, cleanliness, tidiness – and the warmest welcome at  But I have to interrupt my thoughts when Per arrives after finishing his phone call. Immediately, he has to face our questions, because a new sort of packaging caught our eyes. “They are eco cans, from

But I have to interrupt my thoughts when Per arrives after finishing his phone call. Immediately, he has to face our questions, because a new sort of packaging caught our eyes. “They are eco cans, from

Coming back to the eco cans, we wonder where and how Orskov uses them? “

Coming back to the eco cans, we wonder where and how Orskov uses them? “

This system is really impressive. Unfortunately, no blackcurrant product is available in eco cans yet.

This system is really impressive. Unfortunately, no blackcurrant product is available in eco cans yet.