Blackcurrant harvest 2021

For the first time in years, there has been a real shortage in the market. The blackcurrant harvest 2021 has not brought the quantities that everybody expected. 2020 had been a “normal” year for most of the countries, some had suffered from drought and heat. Therefore, many expected a better yield in 2021. But just the opposite happened. Let’s have a detailled look into each country’s challenges!

IBA members may see the detailled figures of the blackcurrant harvest 2021 here.

Country review of the

blackcurrant harvest 2021

United Kingdom

Spring frost and heavy rain in Summer

The British agronomist Rob Saunders, advisor for the growers who produce blackcurrants for Lucozade Ribena Suntory, qualified 2021 as a “miserable year”. The blackcurrant harvest 2021 in the UK has in fact brought only 8.000 tonnes. For an average national crop of around 12.000 tonnes in normal years, this is a severe decline. Saunders counted 18 frosts in April – which heavily affected mainly early varieties like Ben Geirn.

The fruitsetting of course suffered, with up to 70% loss from full crop for early varieties. Even though late season crop did not get any damage during bud break, it still hasn’t led to a good harvest. Like in most of the European countries, there has been far too much rain. In South East England, for example, 25 mm of rain per week have been reported. And not just for one week! This of course has led to a decrease in the quality of the blackcurrants.

Brexit and climate in 2021 – hope for better in 2022

The growing surface in the United Kingdom is static, though. And as there is a lovely extension growth, Rob Saunders hopes that the coming year will be much better for Ribena and its growers.

Apart from the agronomic point of view, the United Kingdom faces severe staffing shortages following Brexit. Moreover, for the same reason, there were haulage issues in the country. It is evident that this also affects the transportation of blackcurrants and blackcurrant products.

Finland

Whereas Finland is not a big player in the European blackcurrant market, it is still interesting to have a look at this country. With around 1600 hectares, its blackcurrant growing surface is slightly higher than the one in France, Latvia, or Germany! Still, the growers in Finland harvest up to 75% less blackcurrants than these countries.

Whereas Finland is not a big player in the European blackcurrant market, it is still interesting to have a look at this country. With around 1600 hectares, its blackcurrant growing surface is slightly higher than the one in France, Latvia, or Germany! Still, the growers in Finland harvest up to 75% less blackcurrants than these countries.

Low yields compared to other countries

Tomi Pousi from the Finnish Association of Fruit and Berry Growers explains this decrease in the average yield:

“One main reason is our climate conditions, especially the winter. It will always impact variety options and yield potential. Finland also had extreme seasons during the latest years: flowering and pollination failed or drought decreased yield levels.”

These are not the only reasons, of course: with an average yield of around half a tonne per hectare in Finland, blackcurrant growing is not very profitable. The consumption of blackcurrants has decreased in recent decades. In addition to this, the processing industry priorizes the cheaper raw material from other countries. Thus, farmers have decreased the production inputs to minimum. Yet, subsidies allow farmers to keep weak fields.

Blackcurrant harvest 2021 in Finland and new trends

However, the demand for Finnish blackcurrants has recently started to increase. Due to this trend, many farmers have started to renew their planting areas and even make new plantations. It will be interesting to see if average yield levels will now rise again.

As far as the blackcurrant harvest 2021 in Finland is concerned, the pollination was not very successful because of heavy rainfalls at the time of flowering. Along with this, an exceptionally hot and dry summer decreased the yield potential in Finland.

Germany

Completely different from a hot and dry summer, most other countries report a particularly rainy and cold season. In Germany, the yield has been correct, and the total amount of blackcurrants harvested has been similar to the previous year. There were huge regional differences, though. Some growers harvested significantly more than last year, others significantly less. The price of the blackcurrants was higher than the past years nonetheless. It reflects what most growers and buyers are happy with.This increase in prices was obviously possible because of a stable demand in the market – for an available amount of blackcurrants significantly lower than usual.

Completely different from a hot and dry summer, most other countries report a particularly rainy and cold season. In Germany, the yield has been correct, and the total amount of blackcurrants harvested has been similar to the previous year. There were huge regional differences, though. Some growers harvested significantly more than last year, others significantly less. The price of the blackcurrants was higher than the past years nonetheless. It reflects what most growers and buyers are happy with.This increase in prices was obviously possible because of a stable demand in the market – for an available amount of blackcurrants significantly lower than usual.

Poland

Report from the blackcurrant harvest 2021

Naturally, we have to look into the situation of Poland from closer. The Polish growers also achieved a higher price than in the past few years for their blackcurrant harvest 2021 – which was of 80.000 tonnes. This has nothing in common with their average yield of 100.000 tonnes.

The crop in Poland this year also suffered from the climate – a cold and wet summer, in sum. In addition, the blackcurrant growing area in Poland has kept decreasing for three years already. Many bushes are not in good conditions any longer. Several growers have changed their production of blackcurrants into the production of red currants – following the evolution of the demand of the market and the evolution of prices for both.

Poland expects the same price for their blackcurrants for 2022 – hoping for a better yield, though.

Fundamental changes

After several years of overproduction, the quantity of blackcurrants produced in Poland now seems to meet the needs of the market. Piotr Baryla, President of the Polish grower association PSPP, expects several growers to stop their production in the coming years nevertheless. Even though the price for the currants may stabilize on a slightly higher level than precedently, the cost of production will increase. Energy costs, the price of fertilizers and wages are bursting.

To add fuel to the fire, there are serious problems with the supply of plant protection products. In Poland, only two approved insecticides remain available for blackcurrants!

Accuracy of figures

One last thing to mention is the accuracy of the estimation of the Polish yield 2021. Whereas the GUS (the Central Statistical Office of Poland) announces not less than 110.000 tonnes of blackcurrants, all players in the market (growers, processors etc.) agree that this figure represents much more than reality. From its experience, the IBA prefers to retain the figure announced by the Polish grower organization PSPP.

France

The blackcurrant harvest 2021 in France has once again suffered from unfavorable weather conditions. Frost in spring damaged the variety Blackdown and caused losses between 15 and 20 %. The more important variety Noir de Bourgogne, main ingredient for the French crème de cassis manufacturers, suffered less. The flowers of Noir de Bourgogne like those of the other varieties came out a little later. Therefore, the yield for these varieties has rather been good everywhere.

Need of variety renewal

However, France experiences serious agronomic challenges. The varieties they need are getting older and older, and the fields need renewal. Yet, there is no other variety available for the moment, which suits the needs of the French market. Along with the challenges of climate change, these facts cause a headache to the French blackcurrant industry. Variety research takes time. And until no suitable variety will have been released, even an increase of the growing surface will not be enough.

Pictures of varietal research in Inhort (Skerniewicze, Poland). Releasing a new variety takes around 10 years.

Latest evolutions in growing surfaces and yields

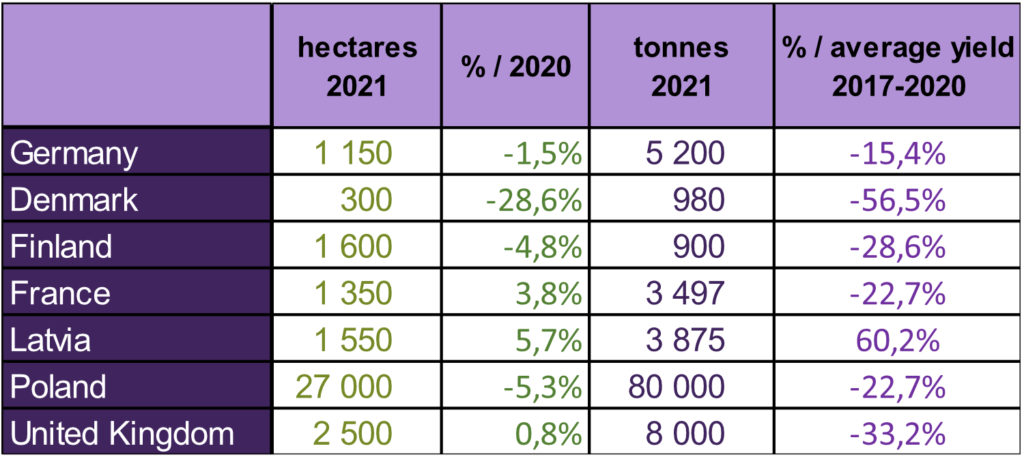

Evolution of the growing surfaces and yields from 2020 to 2021

These statistics of the main European producing countries in 2021 show the decrease in areas compared to 2020 (-4.2%).

Data for Ukraine is unfortunately not available.

Decrease of the growing surface in several Western European countries

The most significant change can be observed in Denmark. Here, one of the largest producers has stopped his production. In total, there is one third less blackcurrant growing surface in Denmark now.

The country does not weigh heavily in the general balance. However, this large decrease in the growing surface in Europe is the direct consequence of the massive arrival of blackcurrants from Poland after the country joined the European Union. This is just one example among many, as the same has happened in Austria, the Netherlands and Germany.

Evolution of the yields

If we examine the blackcurrant harvest 2021, we can see that most countries have had a bad year. They have seen their harvest shrink by more than 20% compared to the average for last 4 years. With the exception of Latvia, which did not suffer from the same climatic hazards as the other countries.

To conclude, we can see that the market may come to a new equilibrium. This could happen thanks to the reduction of the growing surface in Poland – but unfortunately also due to unfavorable weather conditions year after year, .

From a distance to the blackcurrant harvest 2021: general trends

Let’s take some distance from the harvest 2021. The market seems to be stabilizing today. The quantities of blackcurrants available in Europe currently roughly correspond to what the market can absorb. As a result, prices, which had collapsed in recent years, appear to be stabilizing. The level is satisfactory to both producers and buyers. In spite of these facts, we have to stay careful. Andris Krogzems, blackcurrant grower and producer of organic planting material from Latvia, is attentive:

In spite of these facts, we have to stay careful. Andris Krogzems, blackcurrant grower and producer of organic planting material from Latvia, is attentive:

“In my opinion, the reason for the high prices this year is the inertia from last year’s deficit. Producers are buying for both the production process and the provision of reserves, which have been exhausted in 2020.

Also, I cannot confirm a lack of planting material. This has been reported in other countries and would mean that some growers have considerably increased their surfaces. From our nursery’s view, there is no shortage for the coming year.”

Product demand

Destination of the blackcurrants

An overwhelming quantity of the blackcurrants worldwide are processed into concentrate. The needs of this market are stable and of around 90.000 tonnes per year. These concentrates are mainly for the juice industry. We can observe a slight decline in the consumption of juices over the past 2 decades. This is directly related to increasing awareness of the consumers. People today seek for less sugar and more natural products.

Regional demand

For the Cassismanufaktur (Germany), the market of retail sales in small shops or directly from producer to consumer are the center of commerce. Heiko Danner makes several products from his own blackcurrants and sells them mainly on a regional level.

For the Cassismanufaktur (Germany), the market of retail sales in small shops or directly from producer to consumer are the center of commerce. Heiko Danner makes several products from his own blackcurrants and sells them mainly on a regional level.

Changes due to the pandemic?

Edward Thompson from Pixley Berries (United Kingdom) also observes an increase in demand for retail, long life, ambient products, which largely depend on concentrates. This may also be related to major swings in product demand due to Covid. For Thompson, recurring lockdowns in Europe also led to severe reductions in demand for products destined for hospitality.

Edward Thompson from Pixley Berries (United Kingdom) also observes an increase in demand for retail, long life, ambient products, which largely depend on concentrates. This may also be related to major swings in product demand due to Covid. For Thompson, recurring lockdowns in Europe also led to severe reductions in demand for products destined for hospitality.

Still, after the shortage in blackcurrants due to this year’s moderate harvest almost all over Europe, carryover stocks are almost unexisting.

NFC – the most significant trend

As far as new products are concerned, we (the IBA) have not heard from revolutionary changes in the market. Nevertheless, more and more juice producers ask for NFC (Not From Concentrate). This is totally in line with the trend towards a healthier and more natural nutrition. This trend will certainly further develop, and the processing industry will have to adapt.

Production costs

Inflation, hike in energy prices and a surge in the wages are in everybody’s mouths today. Definitely, rising prices are a general concern, and they are already affecting blackcurrant growers in Poland. Dr. Piotr Baryla, President of the PSPP and researcher at the University of Life Sciences of Lublin, explains the situation. Together with the rise of energy costs, the prices of fertilizers exploded: + 300% ! The cost of workers also increases – and on the other hand, the price of blackcurrant remains stable. With the threat of a significantly lower margin, many growers think about quitting.

This reality conceals a fundamental problem in agriculture: the prices of food products which are too low. For farmers, this results in producing below the profitability level.

Climate change and agronomic issues

Increasing challenges year after year

Global warming / climate change (we have already reported on the subject) strongly impacts all countries. Whether it is the lack of frost in winter, late spring frosts, periods of drought or too much rain, heat periods afflicting the plants… In all countries, growers are facing difficulties continuously every year now.

Obviously, reflections and changes must take place on a larger scale than only in the world of blackcurrants. However, a return to polyculture would allow many farmers not only to make better profits by diversifying their production. This would also contribute to a more “natural” form of agriculture.

The end for chemical plant protection products?

Another challenge is already on the way: in Europe, more and more plant protection products are withdrawn from the market. Herbicides are already in the focus. But fungicides and insecticides are also affected: in Poland, there are only two insecticides left. This will obviously impact performance, as alternative sustainable / organic products are not yet available. We will certainly discuss the issue of plant protection products more in detail at the next IBA conference. They have a more immediate and tangible impact than global warming.

New countries

We can observe growing interest in blackcurrants, their health properties and any blackcurrant food product from several countries. Above all, the Americas: not only the USA and Canada, but also South American countries. The IBA regularly receives request for information of any kind from these countries. Followed by other countries: in South East Asia (India, Philippines, Indonesia…), in the Middle East and Eastern Europe.

It seems that there is more and more awareness about our favourite little black pearl, and maybe this is the start of a bright future for it in new parts of the world?